The 0DTE SPX Trade

I've been using a new strategy trading options on the SPX index. It's hit ratio is nothing short of spectacular

For the past month or so, I’ve been using an option strategy that is placed once a day, and it lasts for no more than 2 hours.

The 0DTE SPX Trade

0DTE stands for “zero days till expiration”

Here’s how it works.

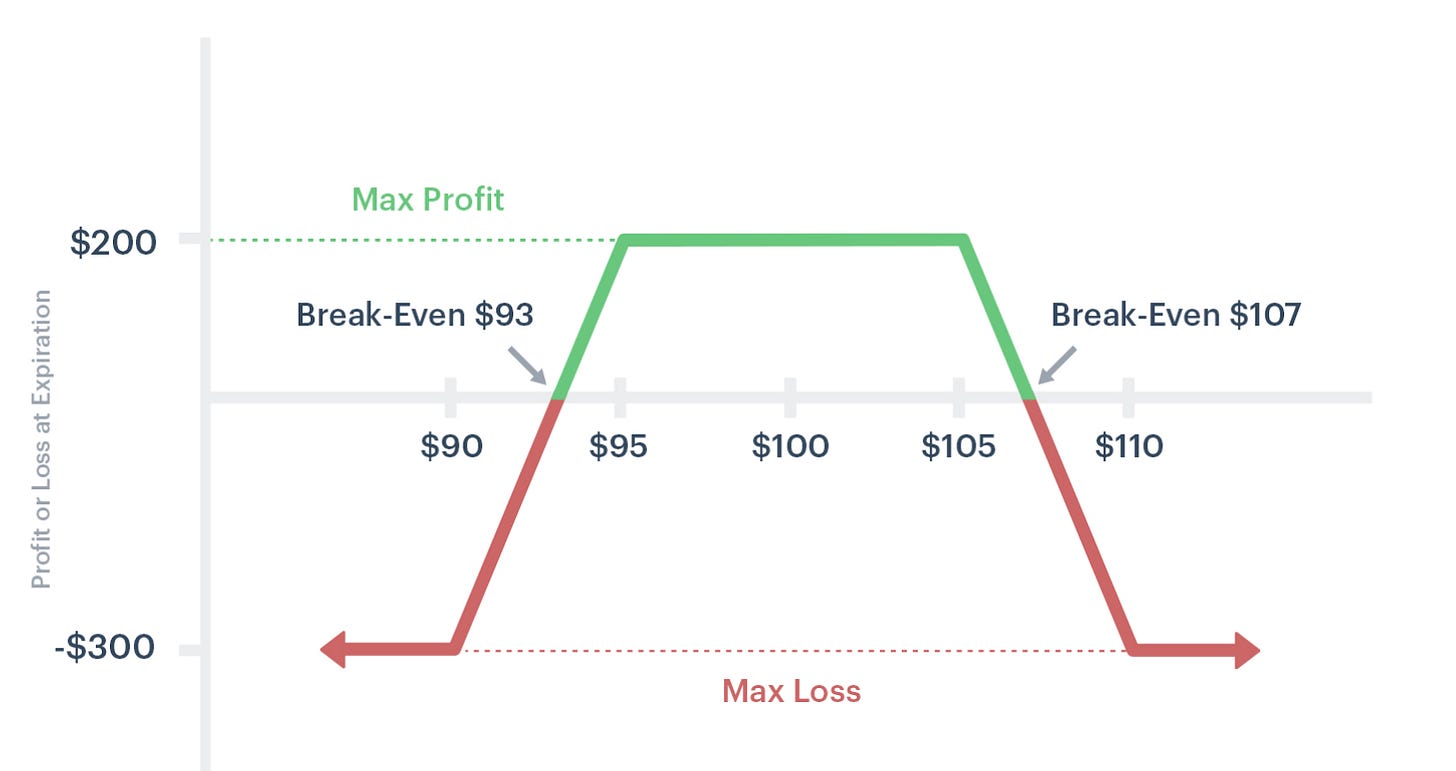

The objective is to receive the most amount of premium, betting on price finishing between two levels or rather, between specific strike prices. The premium we collect is most amount of money we can make on the trade.

I’ve been using an Iron Condor to execute on these trades.

These are bear call spreads and bull put spreads during the same trade.

Here’s what it looks like:

You can see we are protected to the downside while being capped on the upside.

It’s a bet that price finishes (in this example) between 93 and 107. Between 95-105 we max out the profit.

Typically we don’t trade with such low risk to reward, but the win ratio helps offset those occasional losers.

Here’s how I do it:

I start trading around 1:45PM EST, about 2 hrs before the market closes and start marking off levels for the day. I use 15 or 30 min levels.

For identifying levels you can go here:

I’m going to use these levels as my range bound guide.

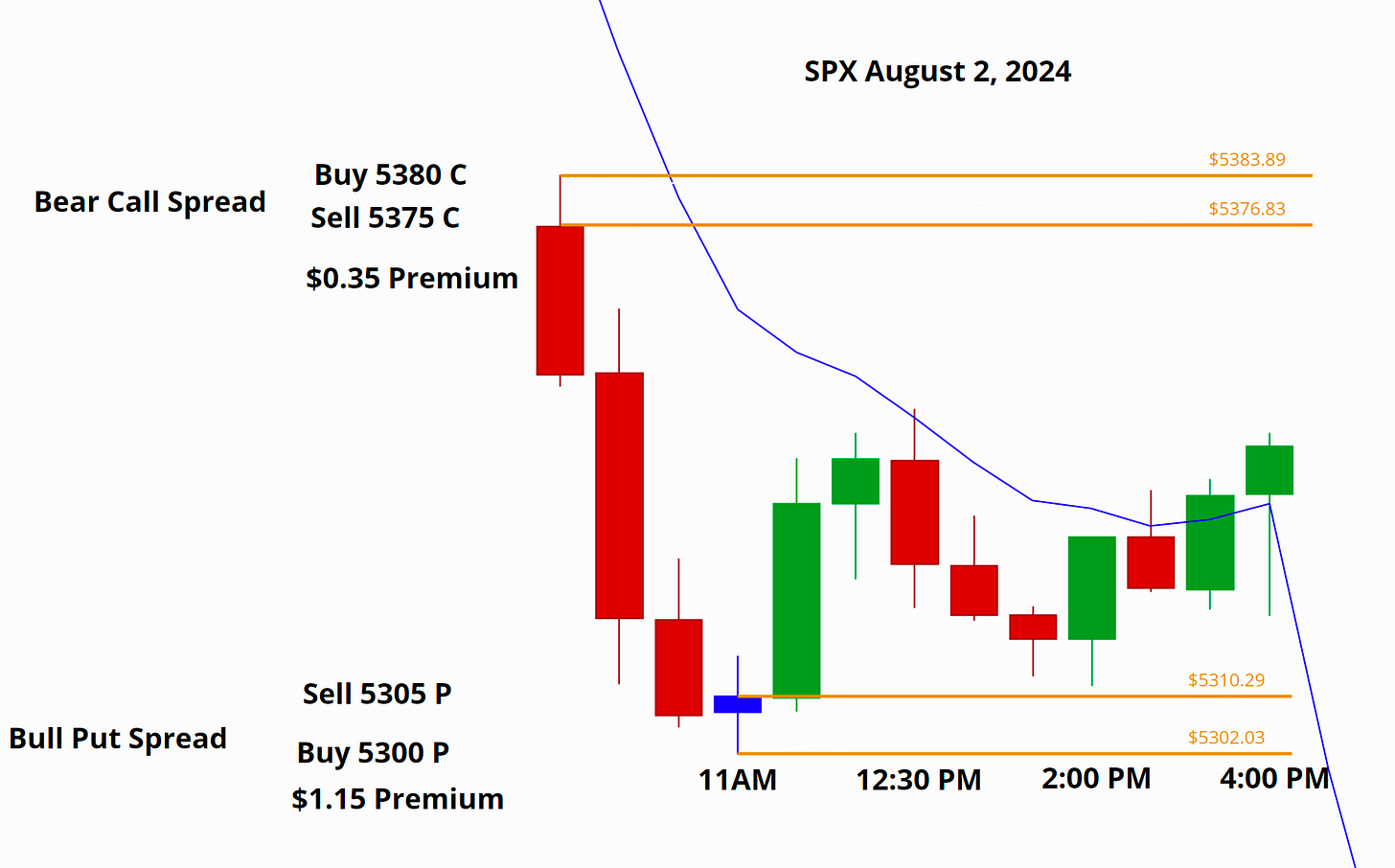

Here’s a real trade I took on August 2nd that spells out the trade

Here we collected $1.50 (or $150) for each contract we take.

Now, to calculate the maximum loss on an iron condor, you follow this formula:

Max Loss = (Width of One Wing - Premium Collected) x Number of Contracts x 100

Given this iron condor on SPX with strikes at 5380/5375/5305/5300:

Width of One Wing: The distance between the strikes in one wing, which is 5380 - 5375 or 5305 - 5300 = 5 points.

Premium Collected: $1.5 per contract.

Now, plug in the values:

Max Loss = (5 - 1.5) x 1 (# contracts) x 100 = 3.5 x 100 = $350 per contract

So, the maximum loss per contract would be $350.

I’m betting price finishes above 5305 and below 5375, and in return I’m collecting $150.

Why 2PM?

In a few words, risk reduction.

One of the biggest risks traders can make when using any option, but specifically 0DTE options is theta risk. Because the option expires at the end of the day theta evaporates quickly, which can lead to significant losses if the trade doesn't move in the desired direction swiftly.

The rapid decay in time value means that even small price movements against your position can result in the option losing most or all of its value in a very short period.

To offset this risk we place the trade when the volume picks up in the afternoon and we are selling the spreads.

We sell the spreads because that is what professional traders do. Most options expire worthless, some 87% of outright option premium is sent up to the trading gods as tribute.

Take a look at this chart:

You can see here in the top two graphs right around 2-2:30PM degens start placing their bets for price to close above or below a specific strike price.

We want to sell to them and be rewarded by collecting premium.

We hedge that sell by wrapping OTM options just above and below our “price finishing between” strike prices.

So on August 2nd, I placed a bet at 2 PM that the lower level would hold and we would closed inside the day’s price range.

Almost immediately, price rallied to the max profit potential and danced around for the last 2 hours.

When I entered the trade at 2 PM, the SPX had already shown some volatility earlier in the day, with a sharp drop in the morning followed by a partial recovery. By the time I placed the trade, the market was likely in a more stable phase, with the SPX attempting to consolidate its position after the midday bounce.

Strategic Entry:

Bear Call Spread (5380/5375): By this time, the SPX was well below the 5375 strike. The decision to sell this call spread was based on the observation that the market faced strong resistance above 5375 when price opened and collapsed. Any significant upward movement was unlikely for the remainder of the day. The $0.35 premium collected reflects the relatively low risk of the SPX breaching this level, considering the time decay and the market's momentum.

Bull Put Spread (5305/5300): The SPX was hovering closer to my put spread strikes when I initiated the trade. Selling the 5305/5300 put spread at this time capitalized on the premium available due to the proximity to the market level, while also betting on the likelihood that the earlier support around 5302.03 would hold through to the close. The $1.15 premium reflects this slightly higher risk but also provided a comfortable cushion.

Trade Dynamics Post 2 PM:

Immediate Reaction: After I put on the trade, the market continued to trade within a narrow range, which was ideal for the iron condor. The SPX stayed comfortably between your upper and lower strike prices, allowing the premium to decay rapidly as the day progressed.

End-of-Day Rally: The market's modest rally into the close pushed SPX higher but remained well within your iron condor's boundaries. This late movement was beneficial, as it moved the SPX further from your lower put strikes while staying far below your call strikes, ensuring that both spreads would expire worthless.

Outcome:

Profitable Trade: By waiting until 2 PM to enter the trade, I maximized the efficiency of the iron condor. Capturing a solid premium of $1.50 while benefiting from the reduced time to expiration, limited the window for unexpected market moves.

Each day, there’s a trade like this that can be used to participate in “selling options to the 0DTE monkeys”

A few notes:

If the market is rallying into ATH’s or in a substantial bull market, it can make sense to only do one leg of the trade, a bull put spread. Considering most rallies continue in strong markets, we wouldn’t want to place a bear call spread in a heavily rising market.

The same is true in a down market:

If the market is falling substantially without any demand in sight, it can make sense to only do one leg of the trade, a bear call spread. Considering most declines don’t advance without hitting solid demand, we wouldn’t want to place a bull put spread in a heavily rising market.

As Always, we use our odds enhancers in this scenario as well. RSI, trend, momentum, larger time frame levels, our EMA’s, fibs, and critical areas are ALL things I consider, even in this type of trading.

Disclaimer: Of course, as always, this isn’t financial advice. Do I know if any of this makes sense? IDK. Stack your odds. Keep it simple.

Great read!

“For identifying levels you can go here: “

Maybe a link missing after this?

Thank you for this. You said : “For identifying levels you can go here: “ is there a link? Also, may I ask what trading platform you use? Fidelity seems to want to “protect” me from zero day…